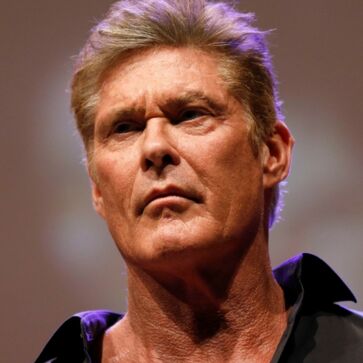

Breaking News: David Hasselhoff Appears in Court Amid Tax Fraud Allegations

In a stunning development that has captured the attention of fans and legal experts alike, television icon David Hasselhoff made a surprise court appearance this morning in Los Angeles amid serious tax fraud allegations. Court documents obtained earlier today suggest that the actor is facing accusations of evading taxes on a significant portion of his income over several years.

According to sources close to the investigation, prosecutors claim that Hasselhoff allegedly failed to report millions of dollars in earnings derived from his various business ventures, including television appearances, endorsements, and concert tours. The documents assert that intricate financial arrangements may have been employed to obscure the true extent of his taxable income. If proven, the charges could result in substantial fines and, in a worst-case scenario, potential jail time.

Representatives for Hasselhoff maintained a composed demeanor as he entered the courthouse, dressed in a tailored suit and accompanied by his legal team. In a brief statement outside the court, his attorney dismissed the allegations as “a misunderstanding of complex financial transactions” and promised a vigorous defense in the upcoming proceedings. “We are confident that once all the evidence is examined, it will become clear that Mr. Hasselhoff has always acted within the boundaries of the law,” the attorney added.

This unexpected legal challenge comes as a shock to many who have long regarded Hasselhoff as a beloved figure in the entertainment world, best known for his iconic roles in “Knight Rider” and “Baywatch.” Industry analysts suggest that while celebrities occasionally find themselves entangled in legal controversies, the scale of these allegations is unprecedented for the star.

The case is expected to unfold over the coming weeks, with court sessions set to scrutinize detailed financial records and testimonies from several key witnesses. Tax experts and legal commentators are already weighing in on the potential ramifications, noting that the case could have broader implications for high-profile individuals and their financial practices.

As proceedings commence, both supporters and skeptics are closely watching every development. This case not only raises questions about the tax practices of public figures but also underscores the complexities of financial regulation in the entertainment industry. Updates will follow as more details emerge in what promises to be a lengthy legal battle for one of television’s most enduring icons. Authorities promise complete transparency as the case unfolds, officials insist.